Hey, Phoenix homeowners and potential buyers! Ready for your weekly real estate check-in? Here’s the news, listings, open houses, events and more! Reach out if you have any specific questions! I’ve enjoyed several conversations this week with friends, colleagues and clients looking for next steps. Enjoy!

Phoenix-Area Real Estate News

The big news is mortgage rates. Yesterday we had one of the biggest 2-day drops in DECADES! I read a great article here and my summary:

Following a surprisingly robust period in November, closed prices have reverted to an average of approximately $285 per sq. ft., slightly below their level two months ago.

On the flip side, the average $/SF for listings under contract has not experienced a decline, maintaining stability at $325. It’s typical for any substantial gap between the green line and the brown line to narrow over time.

The overall market is nearing equilibrium, with some areas leaning towards a buyer’s market and others favoring a seller’s market. Under these circumstances, pricing is likely to remain relatively stable.

For those anticipating significant price fluctuations, whether upward or downward, disappointment may be on the horizon. Significant changes would be necessary for either scenario to unfold.

Concise Market Snapshot

This table provides a concise statistical summary of today’s residential resale market in the Phoenix metropolitan area.

The figures shown are for the entire Arizona Regional area as defined by ARMLS. All residential resale transactions recorded by ARMLS are included. Geographically, this includes Maricopa county, the majority of Pinal county and a small part of Yavapai county. In addition, “out of area” listings recorded in ARMLS are included, although these constitute a very small percentage (typically less than 1%) of total sales and have very little effect on the statistics.

All dwelling types are included. For-sale-by-owner, auctions and other non-MLS transactions are not included. Land, commercial units, and multiple dwelling units are also excluded.

BankRate Mortgage Rates:

For today, Friday, December 15, 2023, the current average 30-year fixed mortgage interest rate is 7.21%, down 20 basis points over the last week. For homeowners looking to refinance, the national 30-year refinance interest rate is 7.30%, down 22 basis points over the last week. Meanwhile, today’s current average 15-year fixed refinance interest rate is 6.41%, decreasing 16 basis points over the last seven days.

New Listings:

New to the Market

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

Upcoming Open Houses:

Don’t forget to bring me!

Open Houses this Weekend

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

Recent Price Changes:

Recent Price Changes

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

Featured Listings:

Hey 55+ friends! Check out my amazing listing for a wonderful house with a low low HOA and a great price! For Sale OR For Rent!

Featured Listings

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

New Build Homes:

Thinking about a new build home? Some might not be ready for a year, but some are close to finished. Homebuilders offer great interest rates (if you use their lender…), and are a viable option for many of my people. But, don’t forget you need representation for YOU…so bring me before you visit a community or Models. The nice person works for the Builder, as does the Lender and the Title Company. Make sure you have someone looking out for YOUR interest and TAKE ME WITH YOU! Just want to shop? I have a great website with all the Valley Builders, shop for features and areas you want WITHOUT being stalked by each and every builder you’re perusing. We’ll visit when YOU’RE ready. Browse safely and securely here.

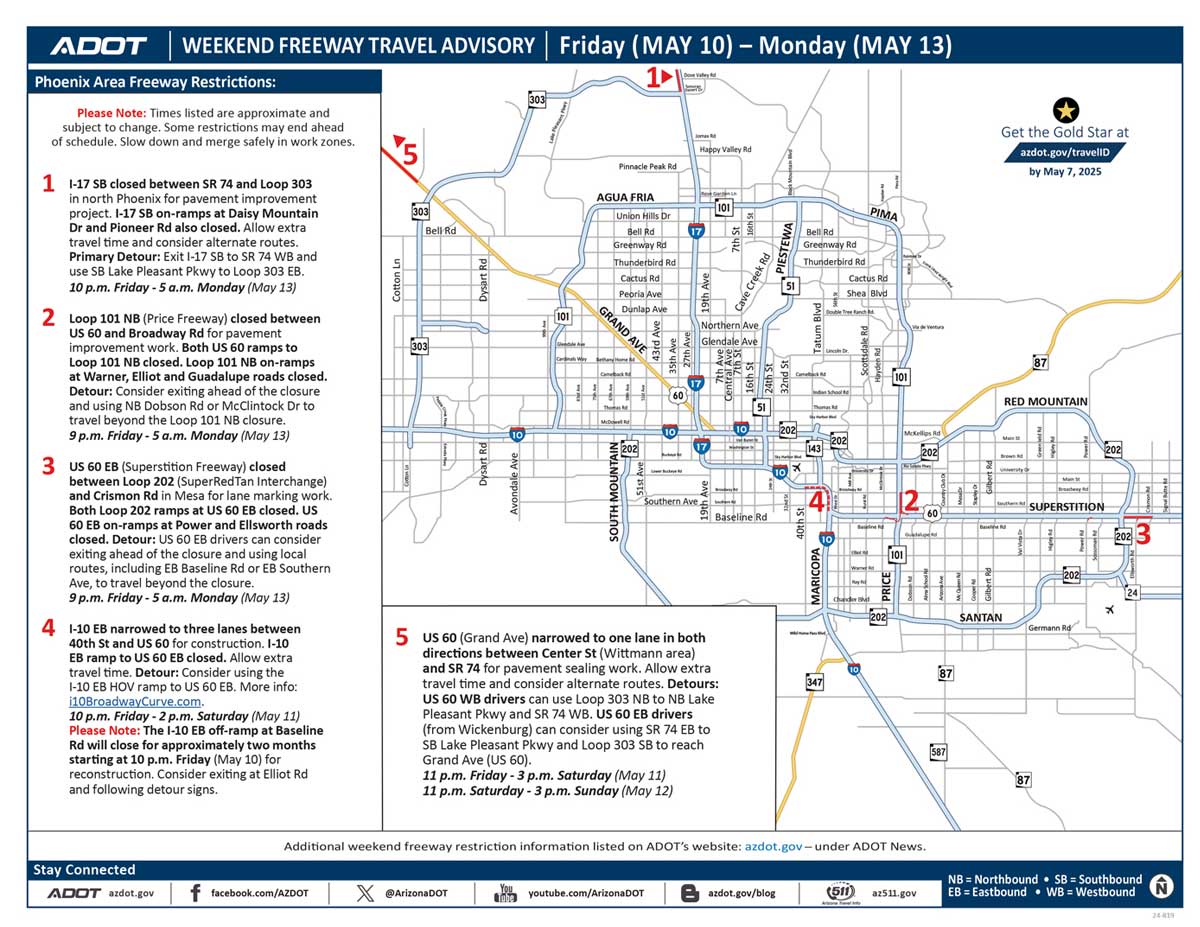

ADOT: No major weekend freeway closures in Phoenix area (Dec. 15-18)

Drivers should use caution with work still possible near freeways.

PHOENIX – No full closures for ongoing improvement projects are scheduled along Phoenix-area freeways this weekend (Dec. 15-18), according to the Arizona Department of Transportation.

To limit impacts on traffic, shopping and the delivery of products during the holiday travel season, ADOT and its contractors schedule work to avoid full freeway closures through New Year’s weekend.

With work still planned near freeways, including during overnight hours, drivers should remain alert, use caution and be prepared to slow down when approaching and traveling through any existing work zones.

Work zones remain in place for the I-10 Broadway Curve Improvement Project in the Phoenix area. Drivers also should use caution and obey reduced speed limits within the I-17 widening project currently underway between Anthem and Sunset Point.

ADOT plans and constructs new freeways, additional lanes and other improvements in the Phoenix area as part of the Regional Transportation Plan for the Maricopa County region. Most projects are funded in part by Proposition 400, a dedicated sales tax approved by Maricopa County voters in 2004.

Real-time highway conditions are available on ADOT’s Arizona Traveler Information site at az511.gov, the az511 app or by calling 511.

Valley of the Sun Sold Listings

- 6318,6208,5731,5487,5833,5156,5582,4732,5816,6966,7329,7117

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Inventory

- 20565,20336,20285,21370,23149,24260,23057,23627,25802,27434,28573,29207

- 8192,7689,8817,9001,9409,7451,6073,11120,10467,11304,11048,9908

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun New Listings

- 8192,7689,8817,9001,9409,7451,6073,11120,10467,11304,11048,9908

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Pending Listings

- 5977,5646,5596,5648,5604,5049,4528,6308,6714,7625,7046,6114

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Absorption Rate

- 3.45,3.46,3.44,3.65,3.96,4.11,3.88,3.94,4.29,4.55,4.73,4.82

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Sale to Original List Price Ratio

- 96.1,96.0,95.6,95.8,96.0,95.8,95.3,95.4,95.8,95.8,95.4,95.3

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Average Days on Market

- 65.2,66.8,71.1,70.3,71.9,71.1,75.7,81.5,79.9,77.7,77.0,75.5

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun New Listings Volume

- 4980817969,4523752249,5499808742,6170989084,6391307461,4971659061,3972402213,8282083343,7131737277,7652762504,7227744476,6391110568

Information is deemed to be reliable, but is not guaranteed. © 2025

What’s Up with Real Estate? National news and local views

Real Estate News in Brief

Normally, we discuss the news in chronological order. But the Fed’s commentary on Wednesday, and the ecstatic market reaction, was too important to not discuss first. The early Christmas presents keep coming for the real estate market. And this was a big one.

Rate cuts coming right on the dot

The Federal Reserve kept its short-term policy rate steady for the 3rd-straight meeting. Nobody really expected a rate hike (or a rate cut), so no surprises there. The official press release didn’t say anything new.

What WAS a surprise was the Fed’s “dot plot” (where Fed members forecast where they think policy rates will be over the next 2 years). 15 of the 19 members expect rate cuts of between 50 and 100 basis points (0.5%-1.0%) over the course of 2024. The median forecast was for 75 bps! Higher for (not much) longer! [Federal Reserve]

The stock and bond market rejoiced. The Dow and the S&P 500 rose to record levels. The yield on the 10-year US treasury bond dropped 30 basis points to 3.93% (not long ago it was threatening to move above 5%). The prices of mortgage backed securities ripped higher. [MBS Highway]

30-year mortgage rates in the 6s! Even before Wednesday’s big moves, average 30-year mortgage rates had already moved down to 6.82%. By midday Thursday, the average 30-year mortgage rate reported by Mortgage News Daily was 6.62% — and this will probably go even lower tomorrow. Mortgage rates have decreased by nearly 1.5% in just two months! [Mortgage News Daily]

Inflation keeps easing

The day before the Fed decision, the November CPI (Consumer Price Index = inflation for me and you) came out. The headline CPI was up just 0.1% month-over-month in November, after being flat in September. On a year-over-year basis, headline CPI eased from 3.2% → 3.1%. [BLS]

And on the day of the Fed decision, we got the November PPI (Producer Price Index = inflation for businesses), which was up just 0.9% year-over-year in November, down from +1.2% year-over-year in October. [BLS]

New NAR Forecasts

The National Association of Realtors’ economics team has adjusted their forecasts for 2024. Here’s what they’re looking for now:

- Existing home sales of 4.71 million, up 13.5% year-over-year

- Median home prices to rise 0.9% year-over-year (most cities up, some cities down)

- 30-year mortgage rates to average 6.3% over the course of the year

- 1.48 million housing starts in 2024, 1.04 million of which will be single-family homes

When it comes to transaction volumes, this is one of the most bullish forecasts out there. (Fannie Mae and Realtor.com forecast flattish existing home sales.) So is the NAR just being an industry cheerleader?

I don’t think so. The NAR also has one of the lowest forecasts for mortgage rates. Makes sense, right? The bigger the bet you make on falling mortgage rates, the higher your forecast for existing home sales should be. And given what mortgage rates have done in the last two months, you can expect other forecasters to play catch-up.

MBS Highway Housing Survey for December

Buyer activity recovered somewhat in December, as the recent 1% fall in mortgage rates coaxed some buyers back from the sidelines. Home prices continued to hold up better than transaction volumes. But with lower rates, slightly improved inventory, and spring around the corner, activity levels may have already bottomed.

- The MBS Highway National Housing Index recovered slightly, rising to 34 in December 2023, from 31 in November 2023. In December 2022, the index was at 14.

- The overall improvement was driven by a 7 point rebound in the Buyer Activity sub-index, which rose from 20 in November 2023 to 27 in December 2023. Clearly, the one percentage point drop in average 30-year mortgage rates during the last 6 weeks brought some buyers back to the market, in spite of limited inventory and seasonal factors. A year ago, the Buyer Activity sub-index was at 15.

- Competition levels have eased in recent months, but the low inventory of homes available for sale in most markets has limited the decline in the National Home Price Direction sub-index, which remained at 41 in December 2023. In December 2022, when home prices were falling month-over-month in most larger cities, the sub-index was at 12.

- All but one of the regional indexes saw a month-over-month improvement in its Buyer Activity Index, with large jumps for the Northeast (30 → 50) and the West (21 → 36) regions. Respondents noted the recent drop in mortgage rates as the driver, with “well-priced” homes still selling very quickly.

Mortgage Market

The early Christmas presents keep arriving, and this week we got a big one. The Fed’s “dot plot” forecasts made it very clear that the majority of Fed members expect policy rates to be much lower by the end of 2024. In other words, they think that inflation has come down far enough (and/or the risks to the economy are high enough) to start cutting rates soon.

Throughout 2023, Chairman Powell has repeatedly used his press conference to pour water on any rate cut excitement. But no hawkish talk this time. Instead, he explicitly said that waiting to cut rates until inflation fell to the Fed’s 2% target (for core PCE) would be a mistake.

This ignited an “everything” rally: stocks, bonds, currencies etc. Higher mortgage bond prices => lower mortgage bond yields => lower mortgage rates. When the dust settled on Thursday, average 30-year mortgage rates had dropped to 6.62%. That’s down almost 1.5% in just two months!

Here’s your links for this weekend’s events!

My Website always has a list of what’s upcoming. Go here and maybe I’ll see you out there!

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Get your Home Value, wealth Snapshot and Ideas what to do with your Equity Every Month!

Join DeDe’s Secret Private Facebook group for tips, tricks, discounts and Freebies!

DeDe’s Social Media

Click on pictures to read/watch

What’s Going on with DeDe?

Got a WONDERFUL Hi-Face treatment from the beautiful and talented D’Lisa at Salon D’shayn! WOW! Check out that before and after, book yours today!

Got to catch up with Three friends (Including Tango the globetrotting pup) and ended up being Serenaded by Jesse Valenzuela of the Gin Blossoms!

Kids are doing great! They’re very helpful with my outdoor projects and decluttering for Bulk trash pickup!

See you next Week!

DeDe