Hey, Phoenix homeowners, potential buyers and investors, friends, clients, and associates! Here’s the news, listings, open houses, events and more! Reach out if you have any specific questions! I’ve enjoyed several conversations this week with friends, colleagues and clients looking for next steps. Enjoy!

Things are definitely looking up! The steep fall in mortgage rates has helped existing home sales improve for the first time in 5 months, and builder confidence also moved up. If your New Year’s resolution is to finally get into a new home in 2024, let’s discuss your preferences and put together a plan. Happy Holidays!!!

What DeDe’s Reading: ATTOM’s 2024 Rental Affordability Report

I read ATTOM’s Report as soon as it was published yesterday. The 2024 Rental Affordability Report by ATTOM reveals that, despite challenges in the housing market, renting a three-bedroom home remains more affordable than owning in nearly 90% of local markets across the U.S. The report indicates that both renting and owning pose financial burdens for average workers, consuming over one-third of their wages in most county-level housing markets.

The gap between renting and owning persists, even as rents have grown faster than home prices over the past year. The analysis incorporates 2024 rental prices, 2023 home prices, and average wage figures. Despite rising home prices and mortgage rates, renting remains more affordable than owning, particularly in populous urban and suburban markets.

Changes in rents have outpaced home price trends in almost two-thirds of U.S. counties analyzed. Renting a three-bedroom home is most affordable in counties with populations of at least 1 million, where it consumes at least 10 percentage points less of average local wages than owning. Honolulu, Brooklyn, Oakland, San Jose, and Orange County are highlighted as having the widest affordability gaps favoring renting.

The report also indicates that renting three-bedroom homes is most affordable in the South and Midwest, with several markets requiring less than one-third of average local wages. However, some counties in the South and West, like Collier County (FL) and Santa Barbara County (CA), show less affordability for renting.

In terms of home ownership, the most affordable markets are in the South and Midwest, while the least affordable are in the West and Northeast. Major expenses on a median-priced single-family home consume over one-third of average local wages in 88% of the counties analyzed.

The report highlights the dynamics of median three-bedroom rents increasing more than wages in some markets, while wages are growing faster than rents in others. Notably, average weekly wages are rising faster than median home prices in 58% of the counties, reversing a pattern seen in 2023.

In summary, the 2024 Rental Affordability Report underscores the ongoing challenges for average workers in both renting and owning homes, with renting remaining a more affordable option in a majority of local markets. The analysis incorporates data from ATTOM’s comprehensive property database and emphasizes the complex interplay of factors influencing the housing market. My Takeaway: If homeownership is your goal, let’s work out a plan to make sure it works for you. Homeowners, it sounds like it’s time to buy an investment property and be an awesome landlord!

Concise Market Snapshot

Here’s the concise market snapshot of the Valley of the Sun. Reach out with any specific questions you have!

BankRate Mortgage Rates:

For today, Friday, January 19, 2024, the current average 30-year fixed mortgage interest rate is 7.00%, down 2 basis points compared to this time last week. For homeowners looking to refinance, the national average interest rate for a 30-year fixed refinance is 7.21%, up 6 basis points compared to this time last week. Meanwhile, today’s national 15-year refinance interest rate is 6.40%, rising 7 basis points compared to this time last week.

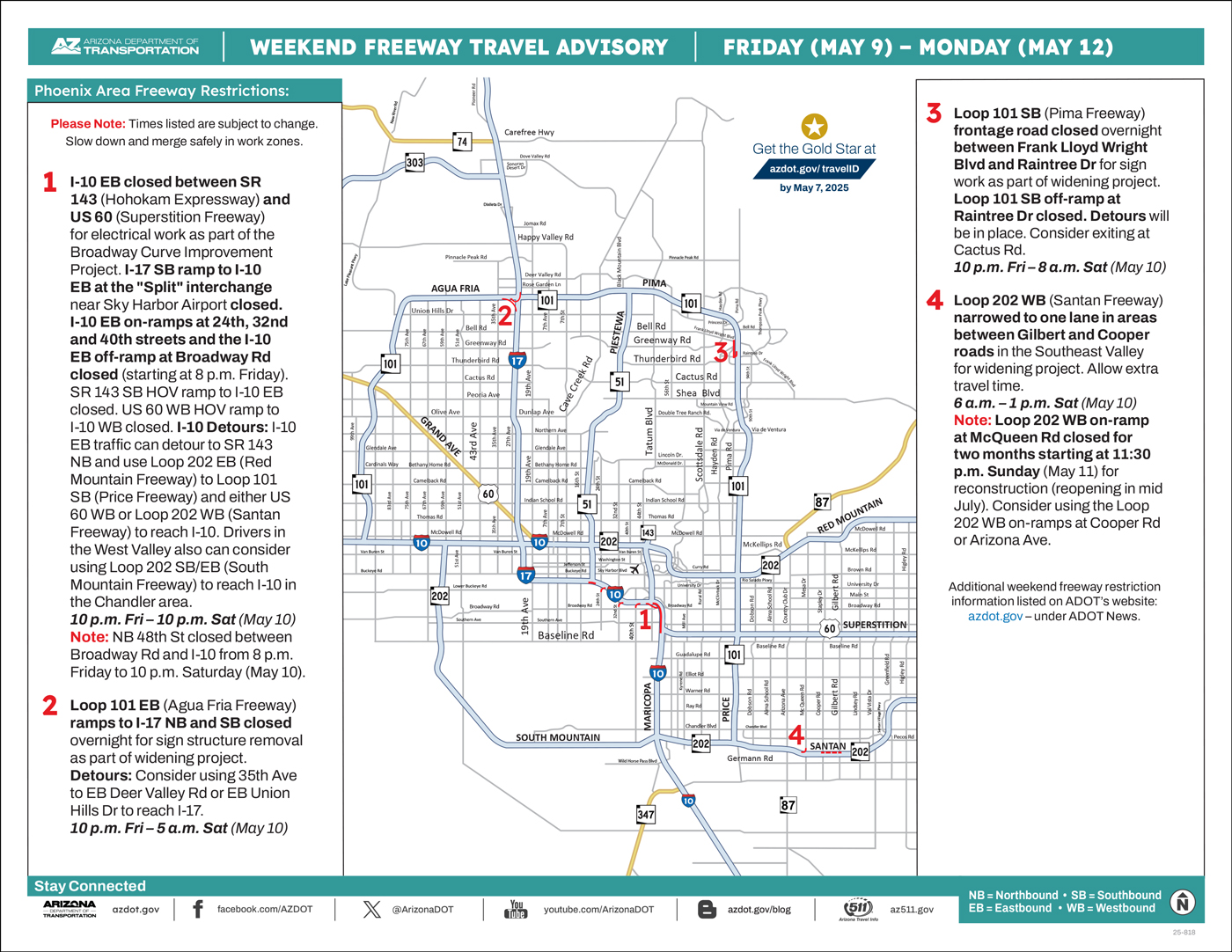

ADOT’s Weekend Freeway Travel Advisory (Jan. 19-22) – Phoenix Area-Plan for I-10 lane restrictions near US 60, southbound SR 143 closure

PHOENIX – Improvement projects will require restrictions along a few freeways in the Phoenix area this weekend (Jan. 19-22), according to the Arizona Department of Transportation. Drivers should consider using alternate routes if necessary while the following weekend closures are in place:

- Westbound I-10 narrowed to two lanes near US 60 (Superstition Freeway) from 10 p.m. Friday to 4 a.m. Monday (Jan. 22) for work on the I-10 Broadway Curve Improvement Project. The westbound I-10 ramp to eastbound US 60 and the westbound I-10 on-ramp at Baseline Road also closed. Allow extra travel time.

- Detour: Consider exiting westbound I-10 at Broadway Road (and turn left) in order to enter eastbound I-10 to reach eastbound US 60. Note: Westbound I-10 on-ramp at 32nd Street closed from 7 p.m. Sunday to 4 a.m. Monday (Jan. 22). Consider entering westbound I-10 via 40th Street.

- Southbound SR 143 (Hohokam Expressway) closed between Loop 202 (Red Mountain Freeway) and I-10 from 10 p.m. Friday to 4 a.m. Monday (Jan. 22) for a traffic shift. Westbound Loop 202 exit to Sky Harbor Airport (Sky Harbor Boulevard) closed.

- Detours: Consider using westbound Loop 202 to eastbound I-10 (at the SR 51 “Mini-Stack” interchange) to reach destinations including Sky Harbor’s west entrance. Drivers also can consider using southbound 44th Street to reach the airport.

- Northbound Interstate 17 narrowed to left two lanes between Dunlap and Peoria avenues from 9 p.m. Friday to 9 a.m. Saturday (Jan. 20) for Valley Metro’s light rail bridge project. Northbound I-17 on-ramp at Dunlap Avenue closed. Please use caution and be prepared to slow down and merge safely when approaching and traveling through all work zones.

- Note: Northbound I-17 HOV lane closed between Dunlap and Peoria avenues from 9 p.m. Saturday to 9 a.m. Sunday (Jan. 21).

- Colter Street closed in both directions at SR 51 from 9 p.m. Friday to 5 a.m. Monday (Jan. 22) for bridge maintenance. Southbound SR 51 off-ramp and northbound on-ramp at Colter Street will be open with no left turns allowed at Colter (bridge closed).

- Detour: Consider alternate routes if needed including Bethany Home Road or Highland Avenue.

Schedules are subject to change due to inclement weather or other factors. ADOT plans and constructs new freeways, additional lanes and other improvements in the Phoenix area as part of the Regional Transportation Plan for the Maricopa County region. Most projects are funded in part by Proposition 400, a dedicated sales tax approved by Maricopa County voters in 2004.

Real-time highway conditions are available on ADOT’s Arizona Traveler Information site at az511.gov, the az511 app or by calling 511.

Featured Listings:

New Listings:New to the Market

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

Upcoming Open Houses:

Don’t forget to bring me!

Open Houses this Weekend

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

Recent Price Changes:

Recent Price Changes

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

Featured Listings:

New Build Homes:

Thinking about a new build home? Some might not be ready for a year, but some are close to finished. Homebuilders offer great interest rates (if you use their lender…), and are a viable option for many of my people. But, don’t forget you need representation for YOU…so bring me before you visit a community or Models. The nice person works for the Builder, as does the Lender and the Title Company. Make sure you have someone looking out for YOUR interest and TAKE ME WITH YOU! Just want to shop? I have a great website with all the Valley Builders, shop for features and areas you want WITHOUT being stalked by each and every builder you’re perusing. We’ll visit when YOU’RE ready. Browse safely and securely here.

Valley of the Sun Sold Listings

- 6318,6208,5731,5487,5833,5156,5582,4732,5816,6966,7329,7117

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Inventory

- 20565,20336,20285,21370,23149,24260,23057,23627,25802,27434,28573,29207

- 8192,7689,8817,9001,9409,7451,6073,11120,10467,11304,11048,9908

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun New Listings

- 8192,7689,8817,9001,9409,7451,6073,11120,10467,11304,11048,9908

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Pending Listings

- 5977,5646,5596,5648,5604,5049,4528,6308,6714,7625,7046,6114

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Absorption Rate

- 3.45,3.46,3.44,3.65,3.96,4.11,3.88,3.94,4.29,4.55,4.73,4.82

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Sale to Original List Price Ratio

- 96.1,96.0,95.6,95.8,96.0,95.8,95.3,95.4,95.8,95.8,95.4,95.3

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Average Days on Market

- 65.2,66.8,71.1,70.3,71.9,71.1,75.7,81.5,79.9,77.7,77.0,75.5

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun New Listings Volume

- 4980817969,4523752249,5499808742,6170989084,6391307461,4971659061,3972402213,8282083343,7131737277,7652762504,7227744476,6391110568

Information is deemed to be reliable, but is not guaranteed. © 2025

National Real Estate News!

Core inflation eases

The CPI (Consumer Price Index) report saw core inflation (excluding food & fuel) ease from +4.0% YoY in November 2023 to +3.9% YoY in December 2023. As a reminder, core CPI peaked in mid-2022 at 6.6%. [Source: BLS] While 3.9% is still a long way from the Fed’s 2% target, the downward trend is clear. The Fed is almost certainly done raising rates. The only question is WHEN they start cutting.

Settling below 7%

Average 30-yr mortgage rates have moved up slightly to 6.78%, but remain well below their recent peaks of just over 8%. [Source: Mortgage News Daily] While Fed members continue to talk tough on inflation, the market is still expecting rate cuts to begin in March, or at the latest May. Wouldn’t it be great if we got lower rates AND more inventory this spring/summer selling season?

Unlocking inventory?

A big reason why the 2023 spring/summer selling season was disappointing was that we didn’t get enough new listings. Many would-be sellers felt ‘locked-in’ by their low existing mortgage rates. But with the big move down in rates recently, things look to be improving. In December 2023, new listings were up 9% year-over-year and total inventory was up 5% year-over-year. [Source: Realtor.com]

Here’s your links for this weekend’s events!

My Website always has a list of what’s upcoming. Go here and maybe I’ll see you out there!

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Get your Home Value, wealth Snapshot and Ideas what to do with your Equity Every Month!

Join DeDe’s Secret Private Facebook group for tips, tricks, discounts and Freebies!

DeDe’s Social Media

Are you joining my declutter challenge? Check it out HERE!

What’s Going on with DeDe

Went to a GREAT show at the Van Buren Last Friday!

Got a great drink at the HighBall Too! Thanks, ROB!

Darci had an accident and ripped off a dew claw. Thanks to Village Animal Clinic for getting her fixed up! Keeping it clean was a challenge (as was getting her to take her pills), but she’s on the mend!

Currently reading:

DeDe