Hello, Happy Friday, the 13th! Here’s the news, listings, open houses, events and more! Reach out if you have any specific questions! Enjoy!

Phoenix-Area Real Estate News

Back to the 80’s? Loan Assumptions, Rate Buy Downs, and Incentives

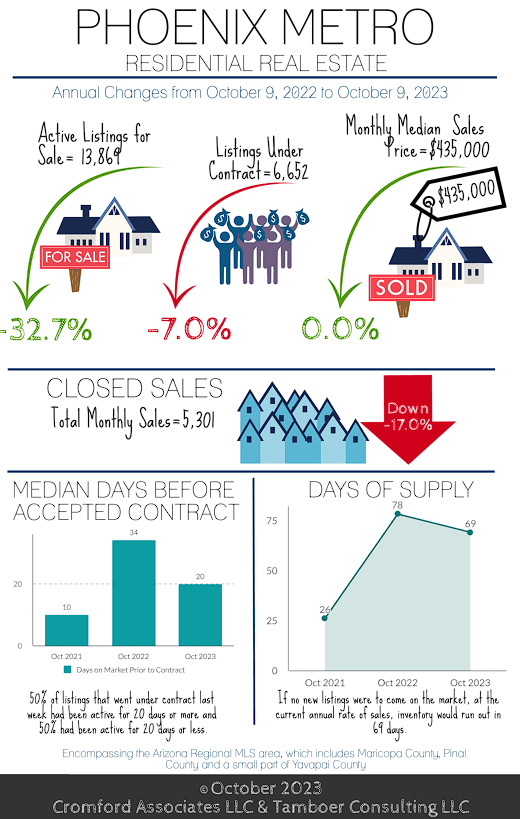

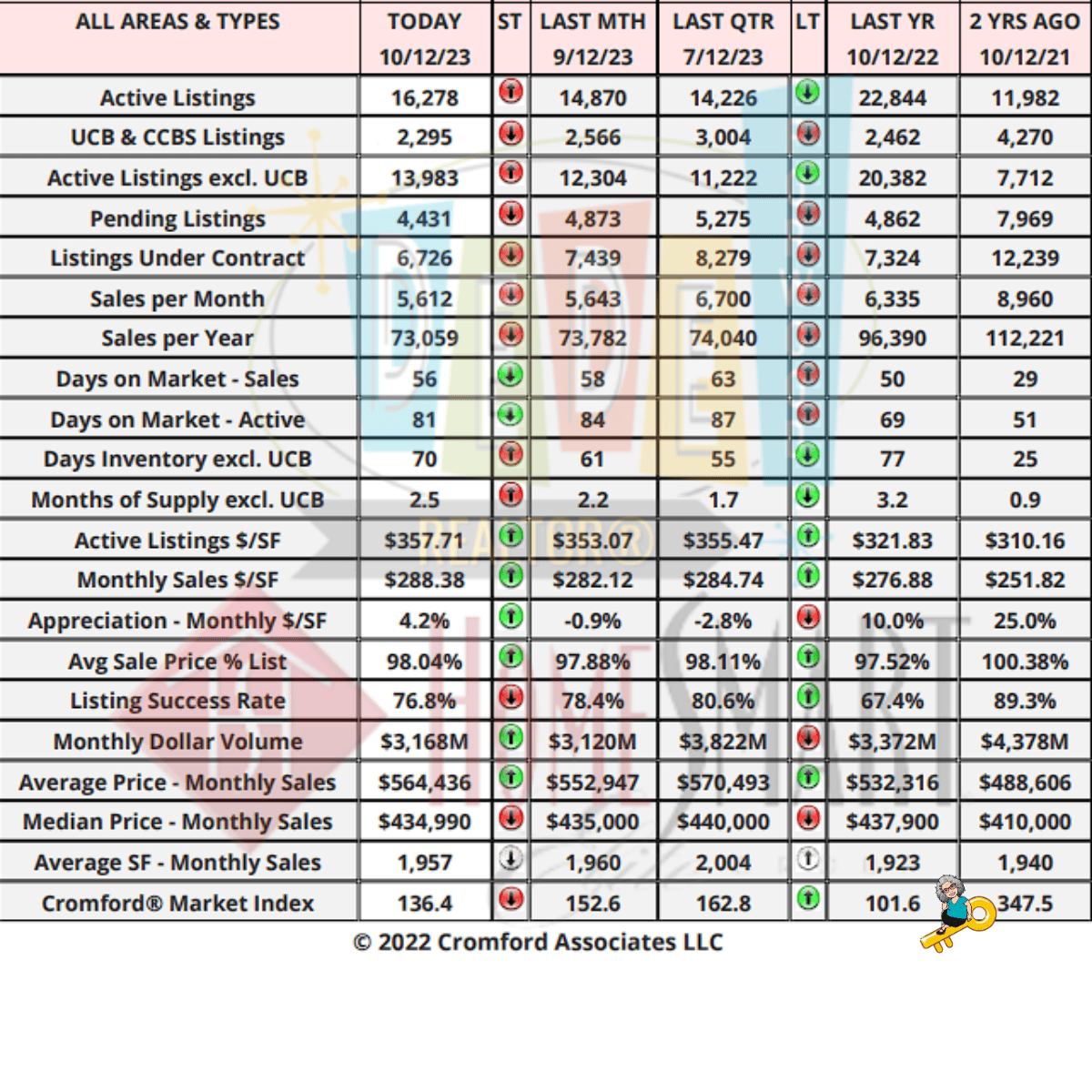

More Choice for Buyers: Supply Up 22% in 10 Weeks

For Buyers:

The 4th quarter is here, and this is the best time of year to be a buyer in Greater Phoenix! Inventory continues to rise, up 22% in 10 weeks to be exact, and price reductions typically peak in October and November. Most sellers listing in October are motivated to close on their homes before the end of the year, but few are more motivated than builders.

New homes make up 22% of active MLS listings and 29% of Maricopa and Pinal County August sales. Builder incentives are including not only closing cost assistance, but select upgrades and significant permanent and temporary rate buy downs. For perspective, let’s use a $350,000 loan. If a buyer uses the seller’s or builder’s closing cost assistance to buy down the mortgage rate by 3% it would save more than $650/month on their payment. Buying the rate down by 2% saves $450/month.

Builders are not the only ones with incentives, however. Last month, 45% of all closings through the Arizona Regional

MLS involved sellers paying buyers’ closing costs with a median of $8,500, about the cost of a 2/1 temporary buy down

on a $365,000 loan. Buyers would be smart to consider areas with heavy competition between builders. The cities of

Coolidge, Maricopa, Tolleson, and Laveen collectively saw 70% of sellers agree to closing cost assistance with 50% of them paying out $10,000 or more.

First-time home buyers may feel like the difficulties they’re facing in today’s housing market are unique and unprecedented. However, high rates like today bring out tools and opportunities for buyers that only emerge when the market is stressed, and they disappear when the market recovers. Baby Boomers, considered to be the wealthiest generation today, didn’t have it so great when they were in their 20’s and 30’s. In the midst of building their careers, growing their families, and purchasing homes, the economy experienced 4 recessions, 4 rounds of high unemployment, and mortgage rates that soared over 10 years from a low of 7% to 18%; it took another 10 years to get back down to 7%. During that time, home sales were low but home values did not decline, similar to today. Here are some stories about how a few of our Baby Boomers and Gen-Xers purchased their first home:

• Mike, 72yo – first home in 1976 for £9,600 at 8.25%, gifted down payment from family and rent-to-own appliances.

Sold it 3 years later for £19,000.

• Tom, 68yo – bought his first home in the 70’s together with 3 friends at 9% as tenants in common.

• Chris, 58yo – first home 1989, paid a distressed seller $4,000 and took over their FHA mortgage payment

• Thomas, over 59yo – first home was a distressed HUD foreclosure he bought for $55K and fixed it up himself

• Michael, 66yo – sold his boat and car to purchase his first home at 8.5%

• Raejean, 57yo – purchased her first home in 1985 at 16.5%

• Kathleen – purchased in 1979 with gifted down payment and 3-2-1 rate buydown

• Kathryn – first home in 1981, interest rates were 18%, but she assumed the seller’s VA loan at 6%

• Nick – bought first home in 1988 with his brother, assumed the seller’s VA loan with $4,500 down and got a roommate to help make the payment, didn’t care about the rate

• Jon – first home in 1981, assumed a VA loan at 10%, seller financed the rest at 10%. Existing rates were 18%

Each one said their decision to buy their first home was a good one in hindsight, even though money was tight and

rates were high. Especially today, it’s highly recommended to consult with a Realtor® and a lender who is fully aware of

available loan programs, FHA and VA loan assumptions, seller incentives, down payment assistance, and other tools

designed to help you on your way to home ownership and building wealth.

For Sellers:

The seller market is weakening in the wake of rising mortgage rates as we head into the 4th quarter. Greater Phoenix is

still in a seller’s market, but at the current rate of decline it could see a balanced market by year end. This means that

sellers should allow for longer marketing times, improving the condition of their homes prior to listing if necessary, and

staying open to funding rate buy downs. Prices are holding tight and are not expected to decline significantly for now.

Concise Market Snapshot

Valley of the Sun Sold Listings

- 6318,6208,5731,5487,5833,5156,5582,4732,5816,6966,7329,7117

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Inventory

- 20565,20336,20285,21370,23149,24260,23057,23627,25802,27434,28573,29207

- 8192,7689,8817,9001,9409,7451,6073,11120,10467,11304,11048,9908

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun New Listings

- 8192,7689,8817,9001,9409,7451,6073,11120,10467,11304,11048,9908

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Pending Listings

- 5977,5646,5596,5648,5604,5049,4528,6308,6714,7625,7046,6114

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Absorption Rate

- 3.46,3.44,3.65,3.96,4.11,3.88,3.94,4.29,4.55,4.73,4.82,4.83

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Sale to Original List Price Ratio

- 96.1,96.0,95.6,95.8,96.0,95.8,95.3,95.4,95.8,95.8,95.4,95.3

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun Average Days on Market

- 65.2,66.8,71.1,70.3,71.9,71.1,75.7,81.5,79.9,77.7,77.0,75.5

Information is deemed to be reliable, but is not guaranteed. © 2025

Valley of the Sun New Listings Volume

- 4980817969,4523752249,5499808742,6170989084,6391307461,4971659061,3972402213,8282083343,7131737277,7652762504,7227744476,6391110568

Information is deemed to be reliable, but is not guaranteed. © 2025

BankRate Mortgage Rates:

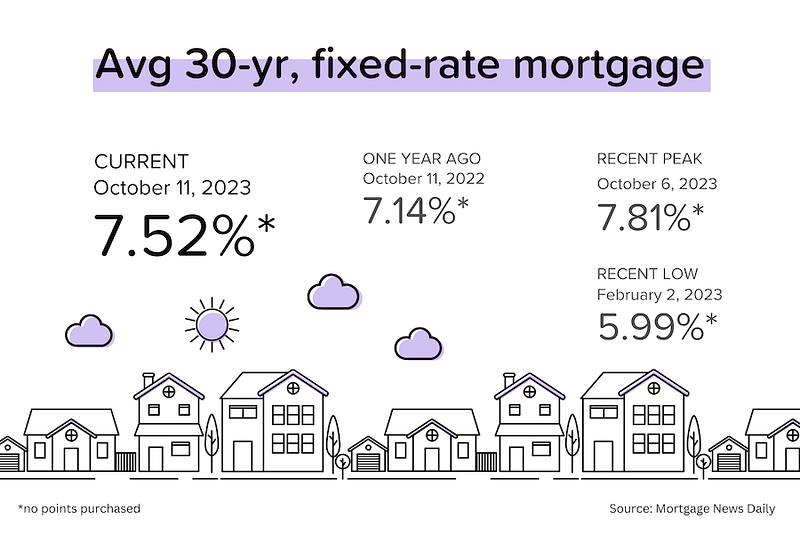

On Friday, October 13, 2023, the current average 30-year fixed mortgage interest rate is 7.89%, increasing 3 basis points compared to this time last week. For homeowners looking to refinance, the current average 30-year fixed refinance interest rate is 8.08%, flat over the last seven days. In addition, the national 15-year refinance interest rate is 7.21%, rising 5 basis points since the same time last week. It’s a challenging market for borrowers.

New Listings:

New to the Market

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

Upcoming Open Houses:

Open Houses this Weekend

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

Recent Price Changes:

Recent Price Changes

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

Featured Listings:

Featured Listings

MLS IDX Listing Disclosure © 2025

MLS IDX Listing Disclosure © 2025

Copyright 2024 Arizona Regional Multiple Listing Service, Inc. All rights reserved. Information Not Guaranteed and Must Be Confirmed by End User. Site contains live data.

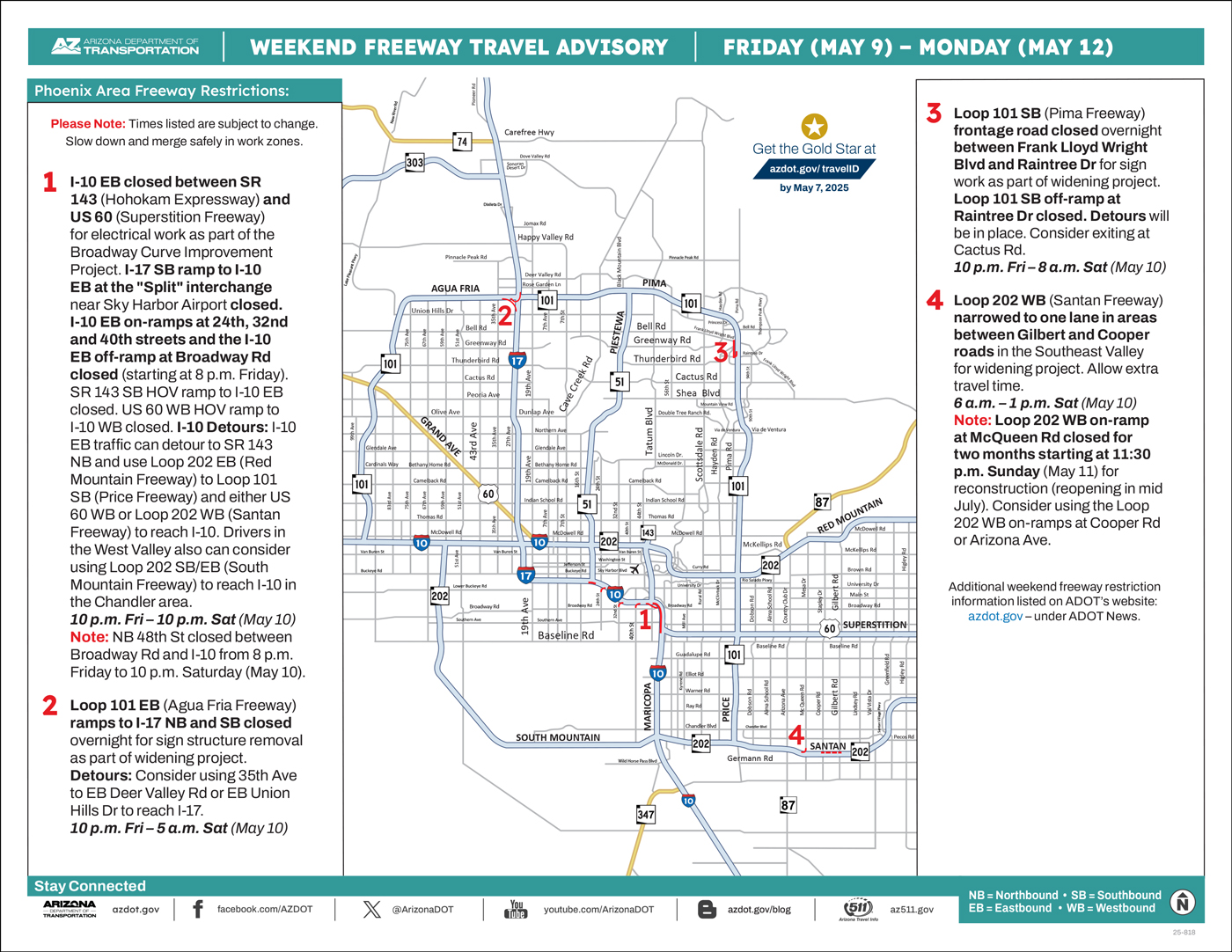

ADOT’s Weekend Freeway Travel Advisory- Phoenix Area:

ADOT’s Weekend Freeway Travel Advisory (Oct. 13-16) – Phoenix Area –Plan for closures along I-10, US 60 and Loop 101 (Pima Freeway)

PHOENIX – Improvement projects will require some freeway closures in the Phoenix area this weekend (Oct. 13-16), according to the Arizona Department of Transportation. Drivers should allow extra travel time and plan detour routes if necessary while the following weekend freeway restrictions are in place:

- Westbound Interstate 10 closed between Loop 202 (Santan/South Mountain freeways) and US 60 (Superstition Freeway) from 10 p.m. Friday to 4 a.m. Monday (Oct. 16) for the I-10 Broadway Curve Improvement Project. All Loop 101 ramps to westbound I-10 closed. Please allow extra travel time. Detours: Westbound I-10 traffic exiting at Loop 202 can travel east to northbound Loop 101 (Price Freeway) in Chandler and use westbound US 60 to reach I-10. Drivers also can consider using westbound/northbound Loop 202 (South Mountain Freeway) to reach I-10 near 59th Avenue in the West Valley. For more info please visit I10BroadwayCurve.com.

- Westbound US 60 (Superstition Freeway) closed at Greenfield Road from 9 p.m. Friday to 5 a.m. Monday (Oct. 16) for bridge work. Westbound US 60 on-ramps at Superstition Springs Boulevard, Power Road and Higley Road closed. Please allow extra travel time. Detours: Consider exiting ahead of the closure and using westbound Baseline Road, Southern Avenue or Broadway Road to travel beyond the closure. The westbound US 60 on-ramp at Greenfield Road will be open but plan for heavier traffic in the area.

- Southbound Loop 101 (Pima Freeway) closed between Shea Boulevard and Rio Salado Parkway (near the Loop 202 interchange) from 10 p.m. Friday to 1 p.m. Saturday (Oct. 13) for pavement sealing. Southbound Loop 101 on-ramp at Cactus Road also closed. Detour: Consider alternate freeway routes including southbound State Route 51 to reach the downtown Phoenix area. Drivers also can use southbound Hayden Road/McClintock Drive or Scottsdale Road.

- Northbound Loop 101 (Pima Freeway) closed between Rio Salado Parkway and Shea Boulevard from 9 p.m. Saturday to 1 p.m. Sunday (Oct. 15) for pavement sealing. Both Loop 202 ramps to northbound Loop 101 closed. The northbound Loop 101 ramps to Loop 202 will remain open. Detours: Consider alternate freeway routes including northbound State Route 51 to reach Loop 101 in the north Valley. Drivers also can consider using northbound McClintock Drive/Hayden Road or Scottsdale Road.

- Eastbound Interstate 10 narrowed to two lanes between US 60 (Superstition Freeway) and Baseline Road from 10 p.m. Friday to 4 a.m. Monday (Oct. 16) for bridge work. Expect slowing through this area and budget extra travel time. For more info please visit I10BroadwayCurve.com.

Schedules are subject to change due to inclement weather or other factors. ADOT plans and constructs new freeways, additional lanes and other improvements in the Phoenix area as part of the Regional Transportation Plan for the Maricopa County region. Most projects are funded in part by Proposition 400, a dedicated sales tax approved by Maricopa County voters in 2004.

Real-time highway conditions are available on ADOT’s Arizona Traveler Information site at az511.gov and by calling 511. Information about highway conditions also is available through ADOT’s Twitter feed, @ArizonaDOT.

National Real Estate News

Real Estate News in Brief

It was another rough week for the housing market, with September inflation (CPI & PPI) coming in higher than expectations, and homebuyer sentiment bumping along the bottom. But more Fed members seem inclined to stop further rate hikes, causing mortgage rates to ease slightly.

Dear Mr. Powell, won’t you help us please? The NAR, NAHB & MBA jointly penned a plea to the Fed Chairman. To paraphrase: you are killing the housing market with high interest rates, please: 1) make it official that you’re done raising rates, and 2) lay off the quantitative tightening.

Has the market finished the Fed’s job? Several Fed officials (including Vice Chairman Philip Jefferson) suggested that the market-driven rise in longer-term bond yields was a form of tightening that could eliminate the need for further rate hikes.

A bad time for buyers. Fannie Mae’s Home Purchase Sentiment Index for September saw the % of respondents saying that it was a “Good Time to Buy” drop to just 16%, the lowest level in 2023, and tied with lowest level in 2022. However, 63% thought it was a “Good Time to Sell.” [Fannie Mae]

The headline PPI figure (Producer Price Index = inflation for businesses) for September rose 0.5% MoM, a good deal higher than expectations. On a YoY basis, headline PPI inflation was up 2.2%, much higher than the +0.2% YoY reported in June. Core PPI was less of a surprise, up 0.3% MoM, versus expectations of 0.2%. [BLS]

The headline CPI figure (Consumer Price Index = inflation for us) for September rose 0.4% MoM, also higher than expectations. On a YoY basis, headline CPI was flat at +3.7%, while core CPI (which excludes fuel & food prices) continued its steady descent, dropping from +4.3% YoY in August to +4.1% YoY in September. [BLS]

The MBS Highway National Housing Index fell to 35 in October 2023 from 42 in September 2023. In October 2022, the index was at 18. Buyer activity continued to slow as average 30-year mortgage rates climbed above 7.5%. But home prices are still rising or holding up in most markets. [MBS Highway]

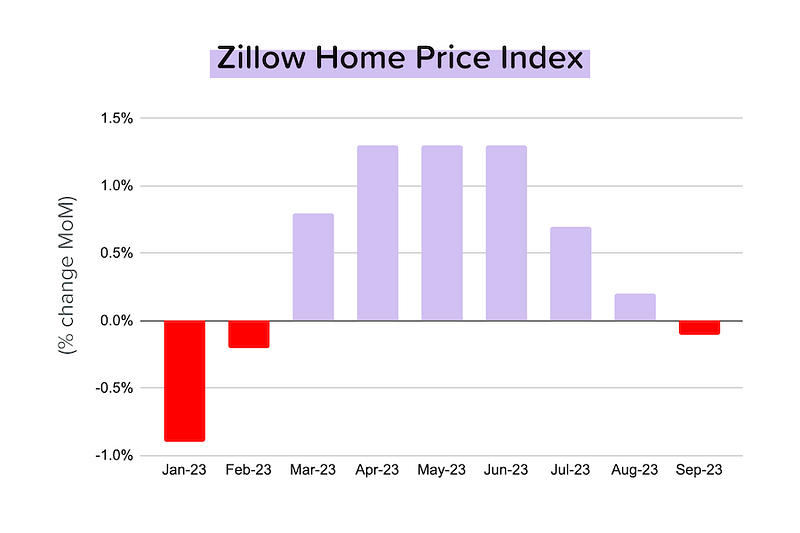

A double-dip in home prices? One datapoint does not a downturn make, but it was intriguing to see Zillow’s Home Value Index DROP 0.1% MoM in September, the first MoM decrease since February 2023. Has the relentless rise in mortgage rates finally hit demand enough to counteract the buttressing effect of low inventory levels? [Zillow]

Dear Mr. Powell, won’t you help us please?

It’s not unusual for the National Association of Realtors, the National Association of Home Builders and the Mortgage Bankers Association to lobby together. But I thought the letter that they jointly sent Jerome Powell on October 9 was unusually aggressive. I’ve cut out a few sections and added my thoughts:

We want to “convey profound concern shared among our collective memberships that ongoing market uncertainty about the Fed’s rate path is contributing to recent interest rate hikes and volatility. This has exacerbated housing affordability and created additional disruptions for a real estate market that is already straining to adjust to a dramatic pullback in both mortgage origination and home sale volume. These market challenges occur amidst a historic shortage of attainable housing.”

[SBB]: They’ve certainly got a point. Affordability has been crushed by the rise in mortgage rates AND home prices. But I didn’t hear any of these people complaining when rates were in the 3s and the gold rush was on!

“We strongly urge the Fed to make two clear statements to the market:

- The Fed does not contemplate further rate hikes

- The Fed will not sell off any of its MBS holdings until and unless the housing finance market has stabilized and mortgage-to-Treasury spreads have normalized.”

[SBB]: In other words, stop playing around and just tell the market that the rate hike cycle is over. The second bullet point refers to quantitative tightening. If the Fed begins to reduce its balance sheet (selling mortgage-backed securities), it can push the price of MBS down (which lifts their yield and can lead to higher mortgage rates).

“Housing activity accounts for nearly 16% of GDP according to NAHB estimates. We urge the Fed to take these simple steps to ensure that this sector does not precipitate the hard landing the Fed has tried so hard to avoid.”

[SBB]: Wow! Aggro! That said, there is nothing wrong with the NAHB’s statement: housing (in the broadest sense) is very important to the US economy, and it is often housing that leads the economy into recession.

New MBS Highway Housing Survey

We’ve made a number of changes to make the MBS Highway Housing Survey faster to take, and the results easier to understand. In short, we transformed all the survey responses into index levels that range between 0–100, with anything above 50 being positive/expansionary. Oh, and we made the infographics a lot nicer to look at.

National Data

Our National Housing Index (top of the image below) dropped from 42 in September 2023 to 35 in October 2023. A year ago — when home prices and transaction volumes were falling across the board — the index was at 18.

Buyer activity continued to slow as average 30-year mortgage rates climbed above 7.5%. The National Buyer Activity sub-index (left side of the image below) dropped to 24 in October 2023 from 34 in September 2023, but remained slightly above the 20 seen in October 2022.

Reflecting strong competition for limited inventory, the National Home Price Direction sub-index (right side of the image below) held up much better, easing to 46 in October 2023 from 49 in September 2023. One year ago, the sub-index was at 16.

Regional Data

Every region saw a significant slowdown in October 2023 relative to September 2023. In the Northwest and Southwest regions, the Buyer Activity index has now slipped below last year’s levels, a clear indication of how quickly things have cooled.

The Northeast and Mid-Atlantic remain the busiest regions, and (together with the West), are the only areas where price direction remains net positive. The recovery in the West region has been remarkable. A year ago, it had the lowest buyer activity and the most negative price direction. Today, it is the 3rd-most active region, with the 3rd-best price direction.

Mortgage Market

September was ugly for the bond market and mortgage rates, with new highs hit almost every week. On October 6, the average 30-yr mortgage rate hit 7.81%, levels not seen since 2000.

The good news (not much of that recently!) is that rates have eased off this week, mainly thanks to public comments from various Federal Reserve officials suggesting that they’ve already done enough to tame inflation.

- “We’re finally getting very good inflation data. If this continues, we’re pretty much back to our target” — Christopher Waller, Fed Governor

- “I actually don’t think we need to increase rates anymore.” Policy is “sufficiently restrictive.” — Raphael Bostic, Atlanta Fed President

- “If long-term interest rates remain elevated…there may be less need to raise the Fed Funds Rate.” — Lorie Logan, Dallas Fed President

They Said It

“Mortgage rates persistently over 7 percent appear to be deepening the malaise consumers feel about the home purchase market,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “In fact, high mortgage rates surpassed high home prices as the top reason why consumers think it’s a bad time to buy a home, a survey first.” — Doug Duncan, Fannie Mae’s Chief Economist.

Here’s your links for this weekend’s events!

My Website always has a list of what’s upcoming. Go here and maybe I’ll see you out there!

Get your Home Value, wealth Snapshot and Ideas what to do with your Equity Every Month!

Join DeDe’s Secret Private Facebook group for tips, tricks, discounts and Freebies!

DeDe’s Social Media:

What’s Going on with DeDe?

During the Amazon Prime Sale, Darci Houdini got a new Lojack with GPS, Wifi and Bluetooth Tracking! She’s staying HOME!

Kids got some Grandpa time!

Today, My Sellers are handing over the keys to a LOVELY Home in Buckeye and preparing for their Move to Surprise!

Finished the Inspections on a Wonderful Home in Surprise my Buyers are Buying.

That’s all for this week! Know I am always here for any questions you have about Buying, Selling, or Investing in Residential Real Estate! HomeOwnership too! Vendors and Tradespeople too! Don’t hesitate to Reach out

See you next Week!

DeDe